What Information is Needed For Property Settlement Assessment?

Which information do you need to collate and organise in order to complete My Fair Share® questionnaire for our property settlement calculator?The information you gather here will also be used by any family lawyer you may engage in future if necessary, so it will save you time and money whenever you decide to pursue your property settlement rights.

First, some personal information about you, your partner and your children (if there are any). At My Fair Share® we do not require any identifying personal details like your name or address, as we are aware of the confidential nature of property settlement inquiries. We only need to know the ages based on month and year.

We would also need to know the length of the relationship, if you are married and when you separated, as you need to be separated for property settlement to take effect. If you have not yet separated, just nominate the date on which you are filling out the questionnaire as date of separation (so the result in our property settlement calculator will show you your entitlement assuming you have just now separated).

Second, we will need property information. This information includes all assets and liabilities of your partner and yourself, including real estate, both your matrimonial home and any investment properties, your cars, your business, trust property and also superannuation because your share in all the properties and superannuation will be determined as part of the property settlement agreement or orders.

Assets - You obviously would not know the exact value of each asset, so use estimates. For real properties - appraisals from real estate agents or even online tools can be used. For cars, use car sale websites or if you want a more accurate value, you can use websites like Red Book which provide you with a more accurate estimate.

Value of a business is a bit more complicated, and your accountant would be the best first point of inquiry about that. Remember, if you are unable to contact an accountant but you know the average profit which the business produces a year, then there are online tools which could assist you in understanding how a value is determined.

Money in bank is easy, just check the bank statements for current balances. These include saving accounts, day to day accounts, terms deposits etc.

As for chattels, second-hand furniture and whitegoods are not worth much so do not overestimate those.

Finally, superannuation can also be established from the annual statements. As for your personal super you can always check, either online or by phone, what is your current balance.

Liabilities – these include loans of any kind including, but not limited to, bank loans secured by mortgages, car loans, personal loans etc. You can ascertain those from latest statements.

Third, information about your specific circumstances. This includes questions about any windfall or financial assistance from family or friends, for example - money given to you or your partner to assist you In buying a house, etc. In relation to each such contribution you would need to provide the amount and the date (roughly) when such contribution was made. This section also includes information about any wastage by one of the parties, such as gambling for example, information about any medical conditions or other special circumstances.

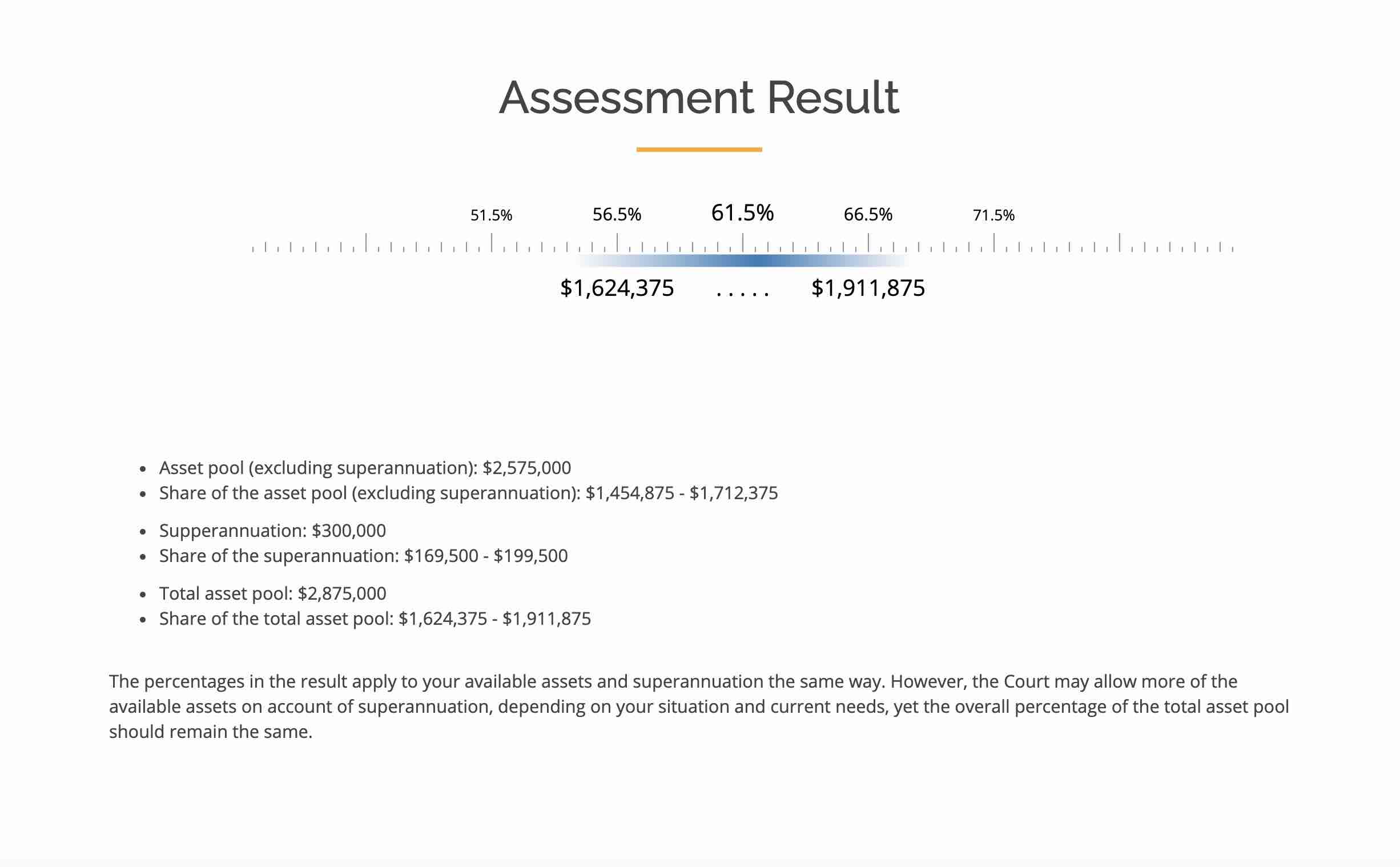

Once all this information is completed you can press the ‘submit’ button at the end of our property settlement calculator’s questionnaire and you will be directed to the payment page, either for one submission or multiple submissions (which allow you to edit and change information), and immediately upon payment, the result of your property settlement is shown, both in percentages and in dollar figures.

The result will show a likely outcome and a range of reasonability, being what My Fair Share® estimates will be the likely maximum share or minimum share of the matrimonial asset pool which you may receive in your property settlement.